A guide to reading through a biblically responsible investing report (BRI).

Here we will show you some sample BRI reports, tell you what they are, and guide you through the various parts to pay attention to.

What is a BRI Screening Report?

A BRI Screening Report is a document put together by our advisory team which showcases the violations or lack thereof for any publically traded stock or fund. The purpose of the report is to help screen a portfolio of any violations that might conflict with your biblical worldview.

Sample BRI Screening Reports

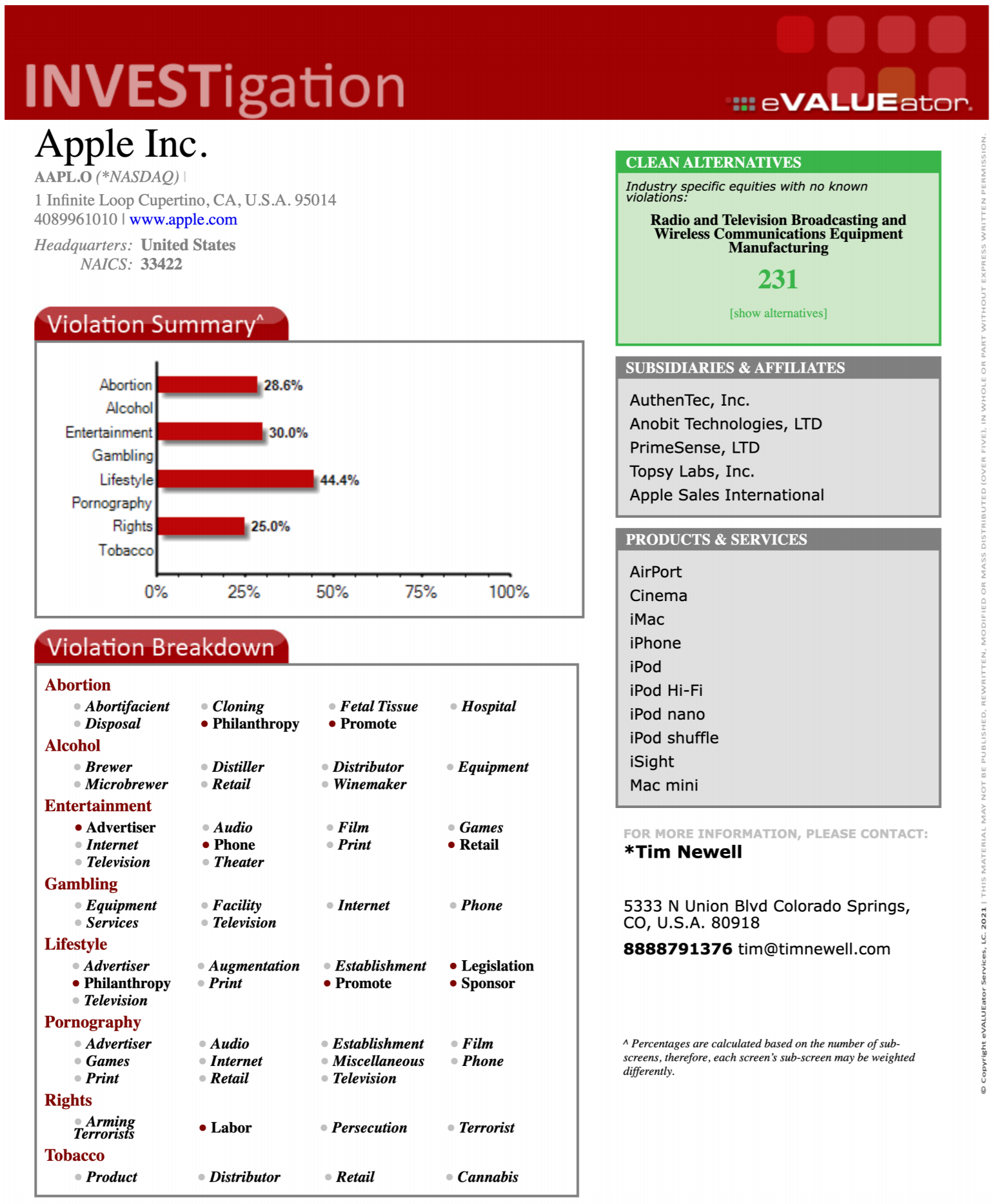

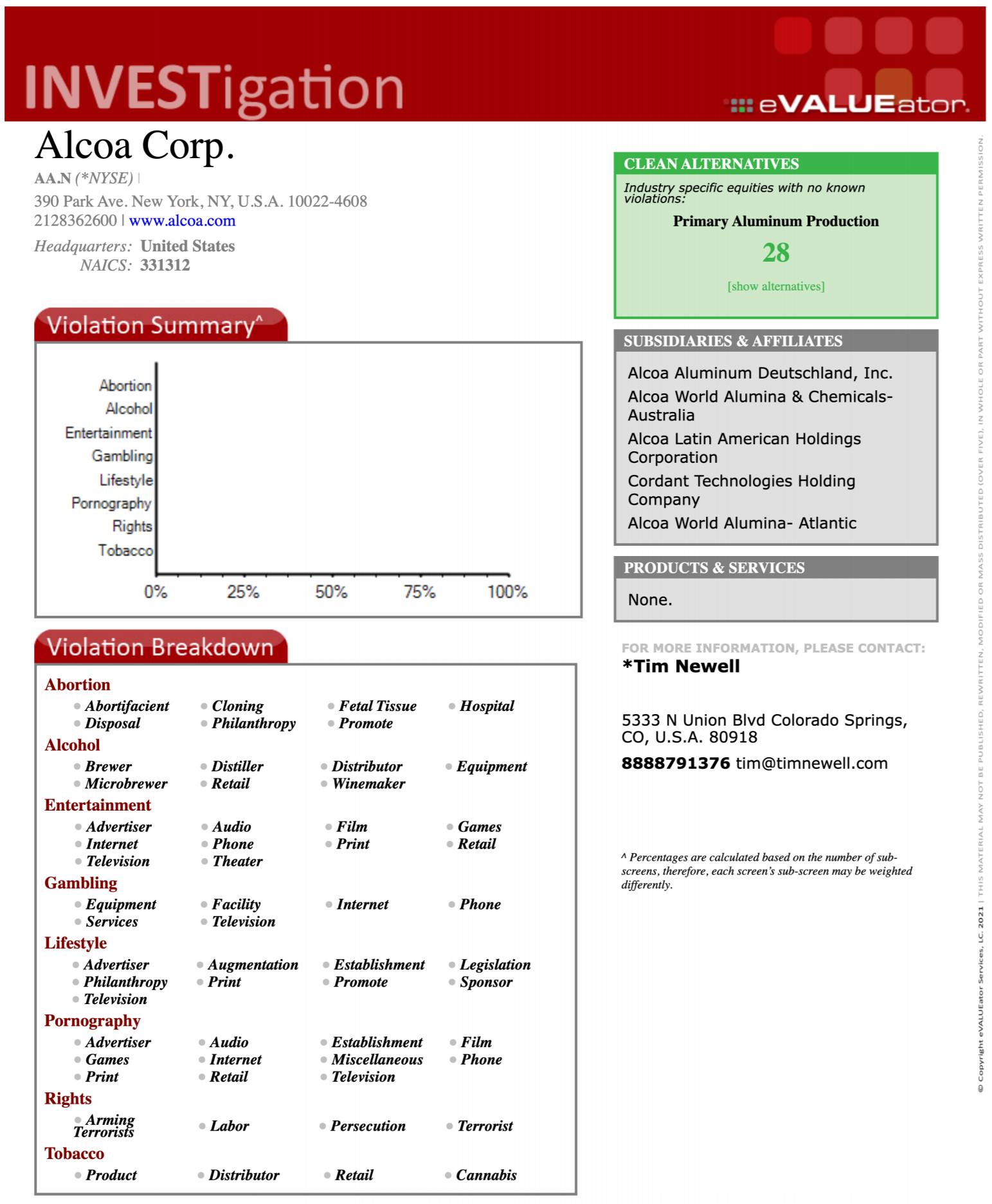

Take a look at both of these sample BRI reports. The first one is a report on Apple and the second is a report on Alcoa Corp. Notice that Apple has a lot of violations and Alcoa is completely clean. A stock needs to be completely clean in order to be eligible for trading in our faith-based investment models.

A guide to reading through a BRI report:

Below you will find a walkthrough, complete with screenshots, of what to expect when you receive a report and what each of the sections means. Please note that the reports for ETFs or other funds are slightly different from reports on stocks.

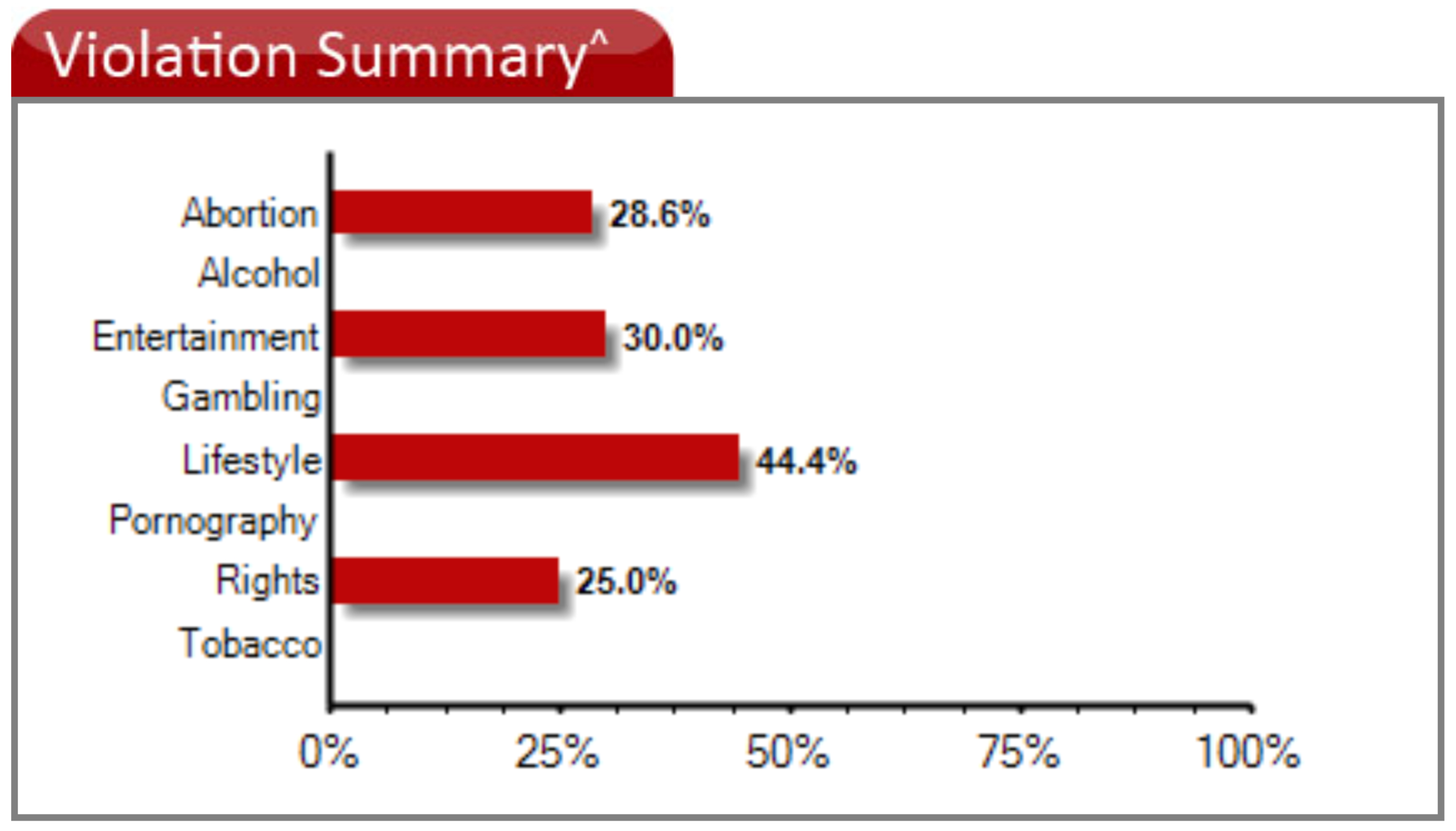

Violation Summary:

Violation Summary is a bar chart that showcases each violation category and the percentage by which the company participates in that conflict. The percentage tells you how heavily the company participates in that violation type. If the chart is blank, it means the company has no violations. The higher the percentage, the more it violates that category.

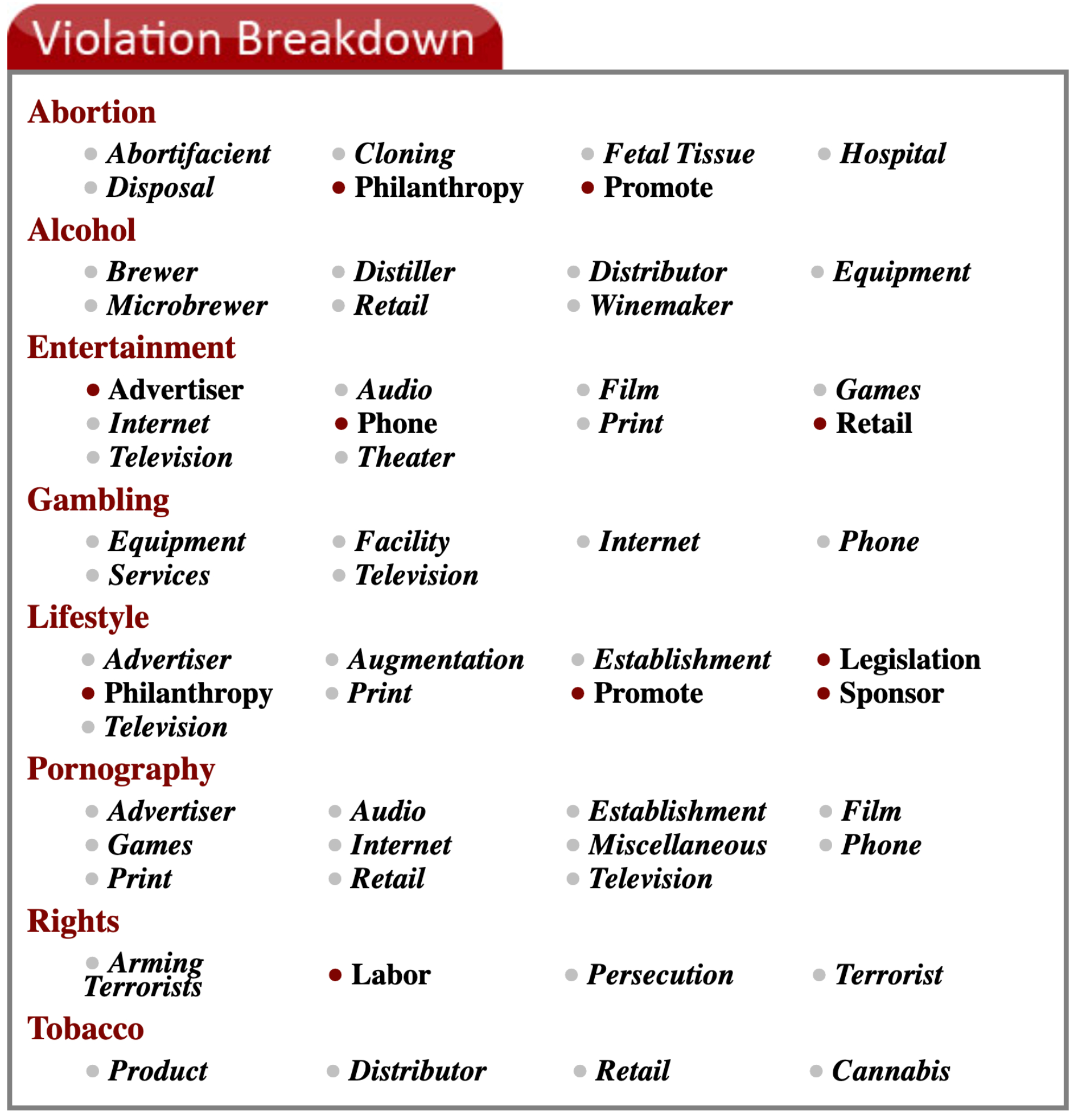

Violation Breakdown:

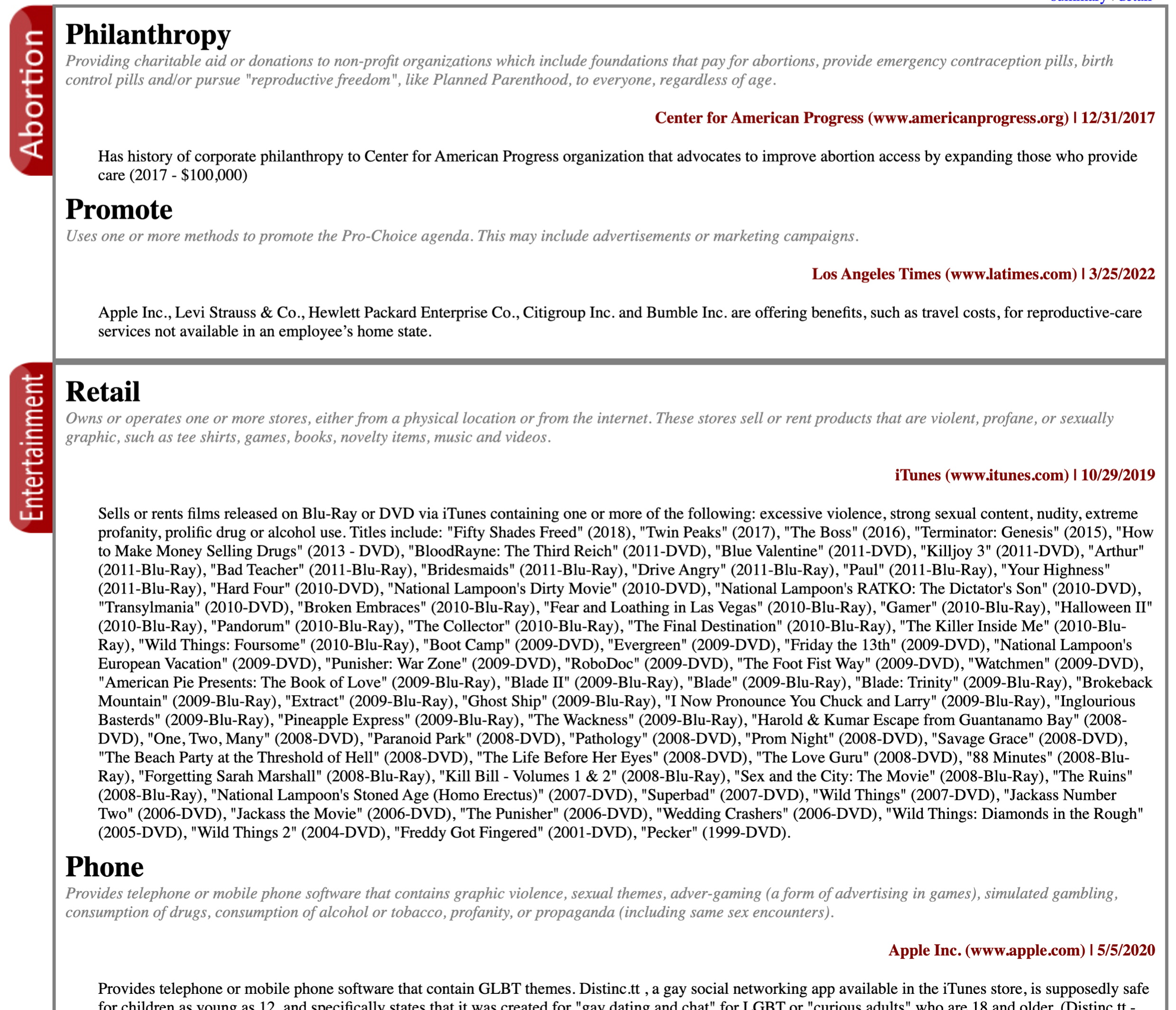

The Violation Breakdown portion is a box with all eight categories listed. Each category has a number of different sub-categories, depending on what type of violation it might be. The box aims to help break down to the next level exactly where you could expect to see the violations to have occurred. The bullet points in red represent the segments where there are violations. Everything in grey doesn’t have any conflicts recorded.

Violation Records:

The remaining page of the report will showcase all the specific instances of violations that were recorded by the investigation team. This portion of the report extends through multiple pages and lists every known violation. If there are a lot of violations, they may be grouped in some fashion.

a. Category name

b. Sub-category type

c. Sub-category description

d. Violation title, date, and reference

e. Violation description