What is the difference between biblically responsible investing (BRI) and socially responsible investing (SRI)?

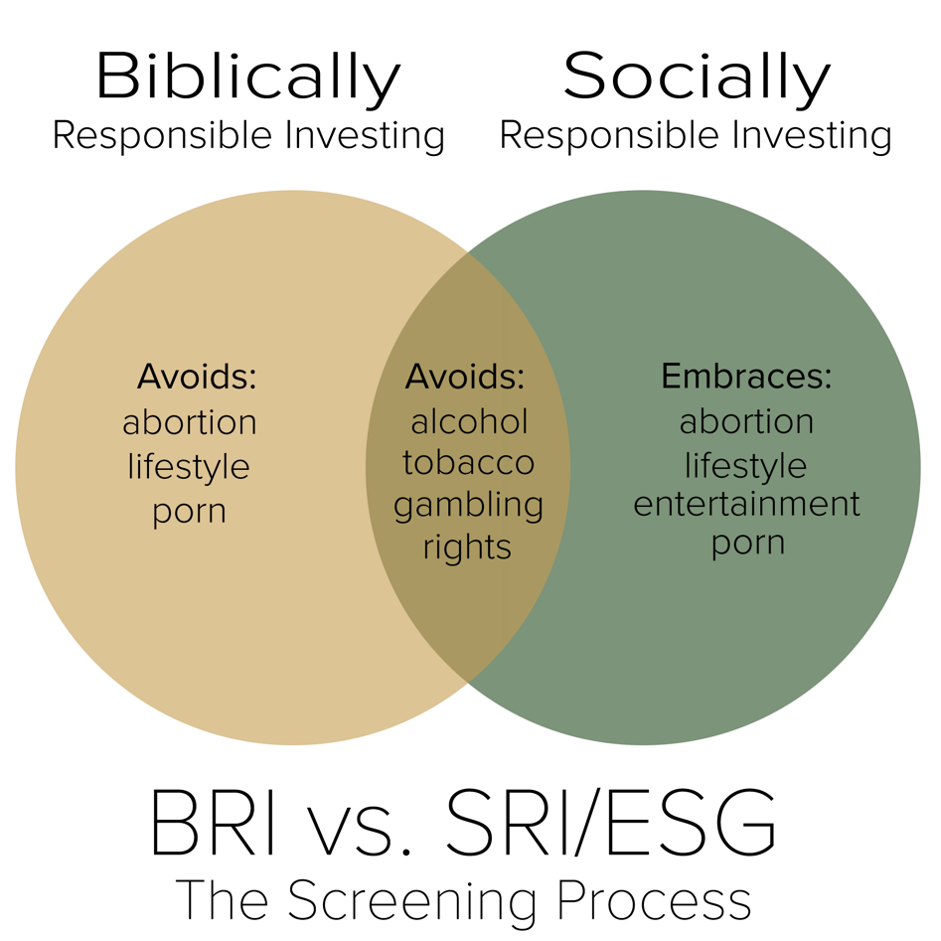

While both portfolio styles seek to filter out unwanted companies, the key difference is in what SRI portfolios are willing to keep. SRI portfolios still embrace companies that support abortion, lifestyle issues, pornography, and crude entertainment.

Values-based investing is a popular method of applying convictions to your portfolio holdings. BRI seeks to eliminate anything from a portfolio that might be against our biblical worldview. SRI or ESG Investing (Environmental, Social, and Governance) is also a values-based way of constructing a portfolio, however, its scope is usually limited only to accomplishing specific goals. Therefore, SRI or ESG based investing might still lead to conflicts with your biblical worldview.

Do you know what you have in your portfolio?