Investing Amidst COVID-19 Waters

Navigating Murky Waters

Coronavirus and your Investment Portfolio Update

Updated as of 3/26/2020

Only a few short weeks ago, on February 19th, the S&P500 was at a record high, as healthy data on the U.S. economy signaled continued growth on the horizon. Then, as the Coronavirus which started in China began to grow in other countries like Iran, South Korea, Italy, Spain, Germany, France and the United States, and over a hundred other countries around the world, markets went into a tailspin, suffering one of the fastest declines on record. The last several weeks have been characterized by extreme volatility as investors try to make heads or tails of the situation.

Coverage around the virus has been almost exclusively negative. Political leaders and the media have attempted to spur drastic action by publicizing worst-case-scenarios. It should come as little surprise, then, that fear of the unknown and of a possible recession is on many people’s minds. It is at times like these that it becomes more crucial than ever to be driven not by fear, but by looking at the data of the current conditions we are in and asking ourselves how this might compare to similar conditions of the past.

There are many positive developments that just aren’t getting media coverage. This is not to diminish the seriousness of COVID-19. We recognize that there is an overwhelming amount of media coverage of the virus; however, the majority of coverage has predominately been negative.

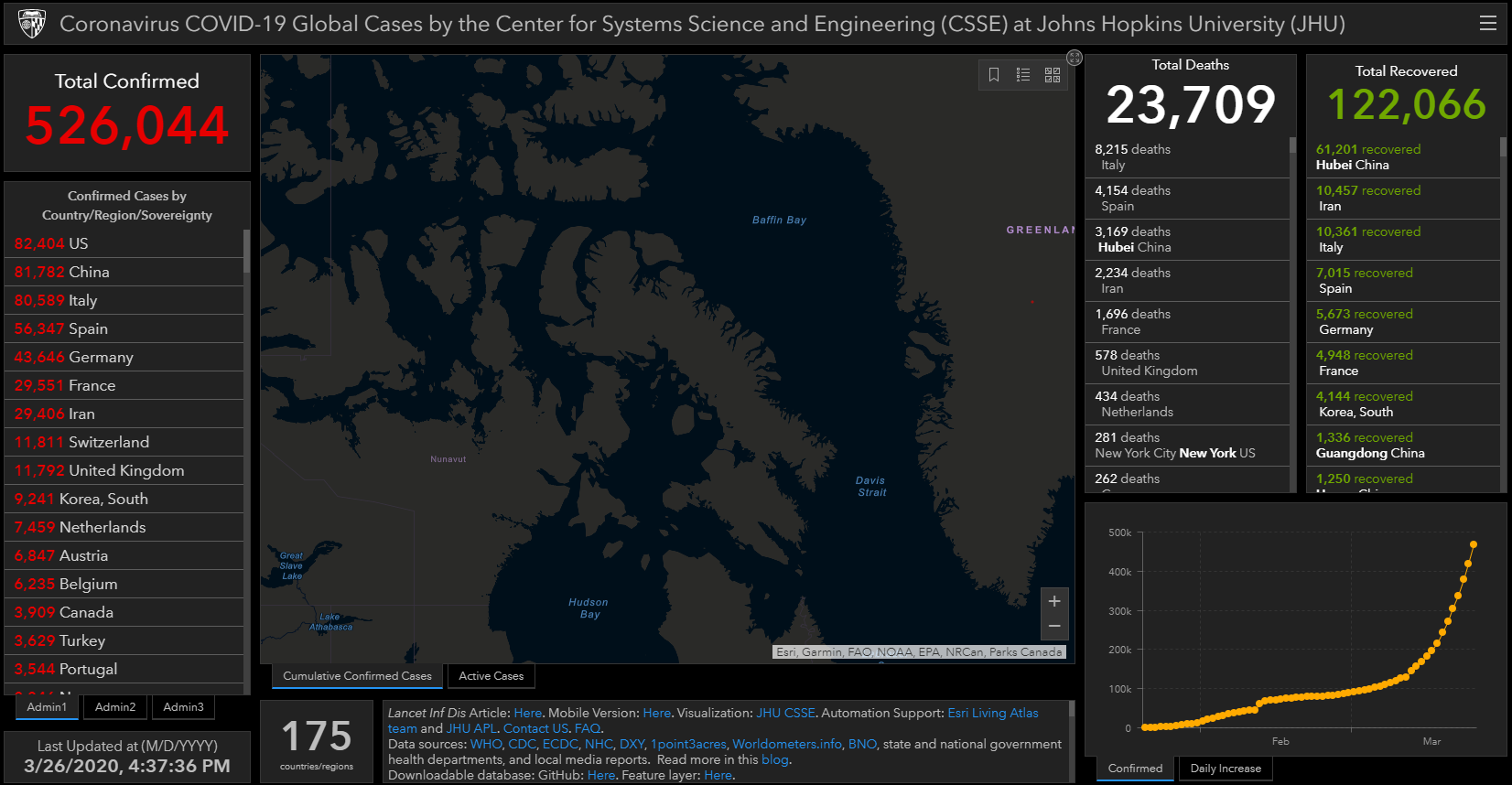

The following map and chart focuses on the numbers of individuals affected by the COVID-19.

A Wave of Recoveries are on the Horizon:

In China, where the Virus started, we are seeing new cases and deaths steadily decline. On Sunday (March 15th), the number of new cases in China was 16 – 12 of which were imported. The number of deaths from the Coronavirus was only 7.

Although the number of confirmed cases in the United States will continue to rise at an accelerated pace, due to more accessible testing, the new cases will, in time, start decreasing, and the number of daily recoveries will surpass any new cases being reported.

History – including the experiences of both China and South Korea with Coronavirus – shows that identification and treatment leads to a slowdown in the pace of new cases and an increase in recoveries. The data shows that, typically, it takes roughly two weeks for otherwise healthy individuals who test positive to recover and be officially moved from the “active” to the “recovered” counts. Now that we are about two weeks out from the initial surge in U.S. cases, recoveries should begin to rise consistently and substantially. The world recovery rate currently sits at 93%. It is reasonable to assume that the U.S. will move toward and then exceed the world recovery rate in the weeks ahead based upon the following.

Testing Capacity Rises Substantially:

Many private labs have now been approved to conduct testing, and the FDA has announced that not only will high-volume testing be allowed, but emergency approval has been given for an automated Coronavirus test that is estimated to speed up the testing process 10-fold. Not only are tests becoming more widely available, results will begin coming quicker as well. Which will better allow us to identify those infected, in order to keep the virus from spreading further.

The U.S. Healthcare Industry is the Best in the World:

One of the most significant positives overlooked by the media, in the fallout from the Coronavirus, is just how fast the private U.S. Healthcare Industry has responded. A number of the companies we are trading in our Coronavirus Defense model have already begun testing vaccines, and many other companies have followed suit with their own treatments. Meanwhile, doctors have already begun using a few experimental anti-viral drugs to treat U.S. Coronavirus patients, with positive results. The speed with which these developments have been made is astounding, a quicker response than even 10 or 20 years ago.

Meanwhile, a 2013 study by the Department of Health and Human Services determined that the U.S. has the most Intensive Care Unit beds per capita of any country at 20-32 per 100,000 people. This is far higher than China where there are only 2.8-4.6, this is one of the reasons why they needed to build hospitals overnight. Likewise, the U.S. far outdoes countries with socialized medical systems like Canada (13.5), Sweden (5.8-8.7), or the UK (3.5-7.4). This means the U.S. is better suited to deal with the healthcare capacity issues that could arise with a Pandemic than virtually any other country in the world.

This in mind, the U.S. is well-poised to not only win its own fight against the Coronavirus, but also to export treatments to help the rest of the world. The coming weeks will be critical as tests go out en masse and we learn more about the fight we are up against. Panic is never permanent, and as the virus response ramps up, sentiment will turn higher as well. Every day we learn more. Every day we make progress. This too shall pass.

Most economist agree that the equity markets are oversold, yet we will continue to see extreme volatility until the panic and fear subsides.

The Fed stepped in with huge rate cuts in an attempt to ease the panic-driven-selloff. The Fed cuts should, eventually, help calm markets; however, it hasn’t yet had that effect. The cuts should allow both businesses and individuals to refinance existing debt at much lower interest rates, which consequently ought to pan out market stress.

With all these economic changes and unfamiliar, murky waters, there’s much to be asked of what we ought to do.

iiConcluding Remarks:

There are many uncertainties we are facing, and often people tend to respond in fear and panic. We at Harvest Investment Services believe that God owns it all and He is our source of real peace in the storm. We know that we can have confidence in his pressence in the storm and also trust in Him to lead us through that storm.

A few toughts we would like to leave you with:

- Panic is NOT a Strategy

- Try to sort through the flow of information we are all getting related to COVID-19. Separate the facts from statements made that are based in fear.

- Try to remember that even though most all of what we hear from the media is negative, there are positive things still happening. For example:

- Today (3/19) no new Coronavirus cases were reported in China.

- Families are spending more time together.

- People are eating healthier.

- The simple things of life have become more important, things like toilet paper.

- This would be a good thing for you to focus on right now as your reading this–Ask yourself: “what are some of the positive things that are happening around you and in the world today?”

Here at Harvest, we’ve been working extremely hard on your behalf. As you know, this has been one of the most rapid declines the markets have ever had. However these types of declines that are event driven often result in a V shaped recovery. Yes, there will be lasting economic effects that will take time to fully recover from, but the United States Of America is extremely resilient. We will get through this and markets will eventually rebound and reach new highs once again. There has never been broad market decline of any amont that the broad markets haven’t fully recovered from and then went on to reach new highs.

Many asset classes are on sale, and there are opportunities to buy great American companies.

You may be in one or more of our models that are taking advantage of the buying opportunities in individual stocks that are in the best positions to profit from the Coronavirus. We also have a few models that can take short positions that make money when markets decline. You can see some of those trades in our Coronavirus Defense trade blotter and Coronavirus Short trade blotter. If you have any interest in incorporating these trades in your portfolio, contact your advisor.

As always, we appreciate the confidence and trust you have placed in us, particularly in times of unrest like this.

Tim J. Newell, CFP, AIF, CKA

Managing Director

More Articles Like This One

Timely Info On The Impacts Of The Coronavirus On The Economy

While the market is in an uproar, we at Harvest wanted to take time to give you insight on how the market is interacting with the Coronavirus. With the media’s constant onslaught of coverage, it can be easy to overwhelm yourself with fear. For that reason, we put together an easy to read report on the market and economic impact during this Coronavirus era.

Get Connected With Us

Call Us

(630) 613-9230

Email Us

support@harvestinvestmentservices.com