Catch-Up Contributions

What are catch-up contributions?

Due to this common distress, Congress in 2001 passed a law that can help older workers make up for lost time in prior years of employment. This “catch-up” provision allows workers who are over age 50 to make contributions to their qualified retirement plans in excess of the limits imposed on younger workers. Few understand how this generous offer can add up over time.2

At Harvest Investment Services, we care about assuring clients offer of the stability and sustainability in retirement that is available to them through catch-up contributions.

How catching up in your contributions works

Contributions to a traditional 401(k) plan are limited to $19,000 in 2019. Those who are over age 50 – or who reach age 50 before the end of the year – may be eligible to set aside up to $25,000 in 2019.3

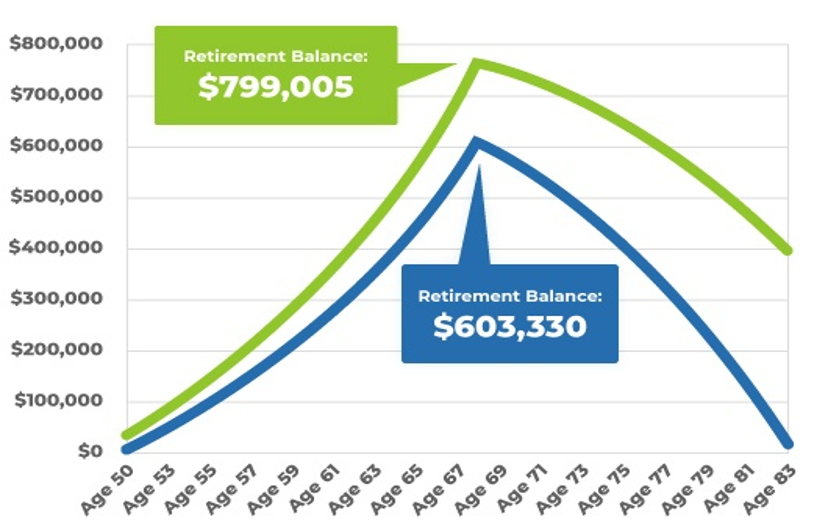

Setting aside an extra $6,000 each year into a tax-deferred retirement account has the potential to make a big difference in the eventual balance of the account, and by extension, in the eventual income the account may generate. (See accompanying chart)

Catch-Up Contributions and the Bottom Line

This chart traces the hypothetical balances of two 401(k) plans in comparison. The blue line traces a 401(k) account into which the maximum regular annual contributions are made each year, without any catch-up contributions. The green line traces a 401(k) account into which the maximum regular and full catch-up contributions are made each year.

Upon reaching retirement at age 67, both accounts begin making payments of $4,000 a month.

The hypothetical account without catch-up contributions will be exhausted by the time its beneficiary reaches age 83, while the account utilizing catch-up contributions remains unexhaustive.

Both accounts assume an annual, 5% rate of return. The rate of return on investments varies over time, particularly for longer-term investments. Contributions to and withdrawals from both accounts have been increased by 2% each year to account for potential 2% inflation. By these presupposed functions, we see comparative growth between the two hypothetical accounts.

Under the SECURE Act, in most circumstances, you must begin taking required minimum distributions from your 401(k) or other defined contribution plan in the year you turn 72. Withdrawals from your 401(k) or other defined contribution plans are taxed as ordinary income, and if taken before age 59½, may be subject to a 10% federal income tax penalty.

2. Economic Growth and Tax Relief Act of 2001

3. IRS, 2018. Catch-up contributions also are allowed for 403(b) and 457 plans. Distributions from 401(k) plans and most other employer-sponsored retirement plans are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. Under the SECURE Act, in most circumstances, you must begin taking required minimum distributions from your 401(k) or other defined contribution plan in the year you turn 72.

More Articles Like This One

What is biblical financial stewardship?

What is Biblical Financial Stewardship? Biblical Financial Stewardship is a theological approach to managing your finances. The idea is rooted in a foundational principle. The principle is that all that you own truly belongs to God.The main idea behind stewardship is...

Budget Check Up: Tax Time is the Right Time

Budget Check Up: Tax Time is the Right Time Keeping on top of your budget Every year, about 140 million households file their federal tax returns.1 For many, the process involves digging through shoe boxes or manila folders full of receipts; gathering mortgage,...

The Cost of Procrastination

When investing for retirement and other long-term goals, the effects of compounding can be one of your best allies. Waiting or procrastinating can eliminate precious time that could have been used to your advantage. The process of saving for retirement and investing that capital is a long and daunting process…

Get Connected With Us

Call Us

(630) 613-9230

Email Us

support@harvestinvestmentservices.com