Market Focus for the Week Ending on May 2nd, 2025

Stocks down over tariff concerns:

U.S. stocks ended the week on a high note, with the S&P 500 Index marking its second consecutive week of gains—the first such streak since January—and closing Friday with a nine-day winning streak. The Nasdaq Composite jumped 3.42%, buoyed by better-than-expected earnings from several large-cap tech companies, while small- and mid-cap indexes posted gains for the fourth straight week. Early optimism stemmed from easing trade tensions, as President Trump scaled back tariffs on cars and auto parts, and Commerce Secretary Howard Lutnick suggested a major trade agreement was nearing completion. As the week progressed, attention turned to earnings, with nearly 40% of the S&P 500’s market cap reporting first-quarter results, including four of the Magnificent Seven. Despite ongoing uncertainty around trade policy and limited forward guidance from companies, investor sentiment remained upbeat, with many confident that businesses could navigate slower economic growth and trade-related challenges

DOW & TECH

THE DOW JONES INDUSTRIAL AVERAGE (DJIA) is the oldest continuing U.S. market index with over 100 years of history and is made up of 30 highly reputable “blue-chip” U.S. stocks (e.g. Coca-Cola Co., Microsoft).

The Dow ended the week up 3.00% at 41,317.43.

THE NASDAQ COMPOSITE INDEX tracks most of the stocks listed on the Nasdaq Stock Market – the second-largest stock exchange in the world. Over half of all stocks on the NASDAQ are tech stocks.

The tech-driven Nasdaq ended the week up 3.42%, closing at 17,977.73.

LARGE, MEDIUM, & SMALL CAP

THE S&P 500 LARGE-CAP INDEX is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The S&P 500 is regarded as one of the best gauges of prominent American equities’ performance, and by extension, that of the stock market overall.

The S&P 500 ended the week up 2.92%, closing at 5,686.67.

THE S&P 400 MID-CAP INDEX is the benchmark index made up of 400 stocks that broadly represent companies with midrange market capitalization between $3.6 billion and $13.1 billion. It is used by investors as a gauge for market performance and directional trends in U.S. stocks.

The S&P 400 mid-cap ended the week up 3.55%, closing at 2,932.10.

THE RUSSELL 2000 (RUT) SMALL-CAP INDEX measures the performance of the 2,000 smaller companies included in the Russell 3000 Index. The Russell 2000 is managed by London’s FTSE Russell Group and is widely regarded as a leading indicator of the U.S. economy because of its focus on smaller companies that focus on the U.S. market.

The Russell 2000 ended the week up 3.22%, closing at 2020.74.

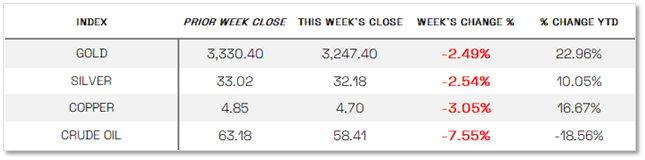

U.S. COMMODITIES / FUTURES OVERVIEW

THIS WEEK’S ECONOMIC NEWS

Mixed Economic Data:

This week’s economic data presented a mixed view of the U.S. economy, with job openings declining but hiring remaining resilient. The Bureau of Labor Statistics reported that job openings fell to 7.2 million in March—the lowest since September—indicating potential softening in labor demand amid economic uncertainty. ADP’s report showed private payrolls increased by just 62,000 in April, a sharp drop from March’s revised 147,000. However, Friday’s BLS payrolls report offered a more optimistic signal, with 177,000 jobs added in April—well above expectations—while the unemployment rate held steady at 4.2% and wages rose modestly. Stocks responded positively to the upbeat labor data. Meanwhile, the Bureau of Economic Analysis announced that GDP contracted at an annual rate of 0.3% in the first quarter, marking the first decline since 2022, driven by increased imports, slower consumer spending, and a drop in government outlays—likely influenced by companies accelerating purchases ahead of new tariffs. On a brighter note, the PCE Price Index was flat in March and consumer spending rose 0.7%, suggesting economic resilience and easing inflation pressures, though the full impact of recent tariffs has yet to be reflected.

Earnings Focus:

The 1st Quarter 2025 earnings reporting is ongoing, with 74% or 357 companies having reported earnings. Of the companies that have reported, 74% have reported earnings above analyst expectations. This is below the five and ten-year average of 77% and 75%. The projected Year over Year earnings growth rate for the S&P 500 is currently 13.6% while YOY revenue growth is 4.6%.

When you examine the individual sectors, seven of the eleven sectors are estimated to report a year-over-year increase in earnings. The Health Care and Communications sectors have the highest earnings growth rate for the quarter, while the Energy sector has the lowest anticipated growth compared to Q1 2024. The forward four-quarter P/E ratio of the S&P 500 is 20.6, which is above the ten and thirty-year average.

During the upcoming week, 92 S&P 500 companies (with 1 Dow 30 components) are scheduled to report results for the first quarter.

THIS WEEK’S HIGHLIGHTED STORY

https://www.visualcapitalist.com/americas-most-valuable-company-in-each-year-1995-2025/

May 1, 2025

What We’re Showing:

While industrial giants like General Electric were once the most valuable companies by market capitalization, they’ve since been overtaken by tech-driven firms like Apple and Microsoft.

This transition reflects the economy’s pivot from manufacturing and energy toward software, data, and digital infrastructure. In recent years, investor enthusiasm for AI has driven valuations to historic highs, with trillion-dollar companies becoming a new normal.

In this graphic, we highlight America’s most valuable company in each year since 1995, based on Q1 market cap. Numbers are not adjusted for inflation.

Key Takeaways:

Apple and Microsoft Trade Places at the Top

Apple and Microsoft have dominated their competition for many years, frequently swapping places as the biggest company in the United States.

Apple’s ascent is fueled by its ecosystem of consumer electronics and services, particularly the iPhone. Microsoft, on the other hand, owes its valuation to its commanding share of the enterprise software (e.g. Office 365) and cloud computing sectors.

Both companies are developing artificial intelligence and have been working on integrating it into their respective offerings.

Nvidia’s Brief Moment at #1

Nvidia briefly disrupted Apple and Microsoft’s duopoly when it became America’s most valuable company on two occasions in 2024 (June and October).

The company’s massive boom is the result of its GPUs being critical for AI data-center expansion, and a belief that AI-driven technologies will rapidly reshape the world’s industries.

.

Sources:

All index and returns data from Norgate Data and Commodity Systems Incorporated and Wall Street Journal

W E Sherman & Co., LLC. W E Sherman & Co., LLC. News from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, visualcapitalist.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet, Morningstar/Ibbotson Associates, Corporate Finance Institute. LSEG I/B/E/S, Factset Earnings Insight

Commentary from T Rowe Price Global markets weekly update — https://www.troweprice.com/personal-investing/resources/insights/global-markets-weekly-update

This report is provided for informational purposes only. This report does not constitute an offer to sell or a solicitation or an offer to buy any securities. Any reference to a specific security included in this report does not constitute a recommendation to buy, sell or hold that security. Consult with your advisor for advice. All investments involve risk, including loss of principal. Principal values and investments returns are neither guaranteed nor issued by, guaranteed by, or obligations of a bank, savings and loan, or credit union; and are not insured or guaranteed by the FDIC, SIPC, NCUSIF or any other agency. Advisory Services offered through Harvest Investment Services, LLC, a Registered Investment Advisor.