Downside Risk Controls

Tools to help Harvest Gains and Limit Losses.

Why are Risk Controls important for the performance of a portfolio?

How well did your portfolio fare during the last market decline? Are there ways one can avoid market declines in an effective way? The answer is yes. Many investors have in one way or another attempted to limit their downside risk. As an investor, you may have been told diversification is the best way to limit your risk. While it does offer some protection, it does have some weaknesses you should be aware of. Additionally, there are other effective ways that might better serve your portfolio. Harvest utilizes a number of different downside risk controls to help balance risk with reward. These controls can make a huge difference in your portfolio.

The Myth of Diversification

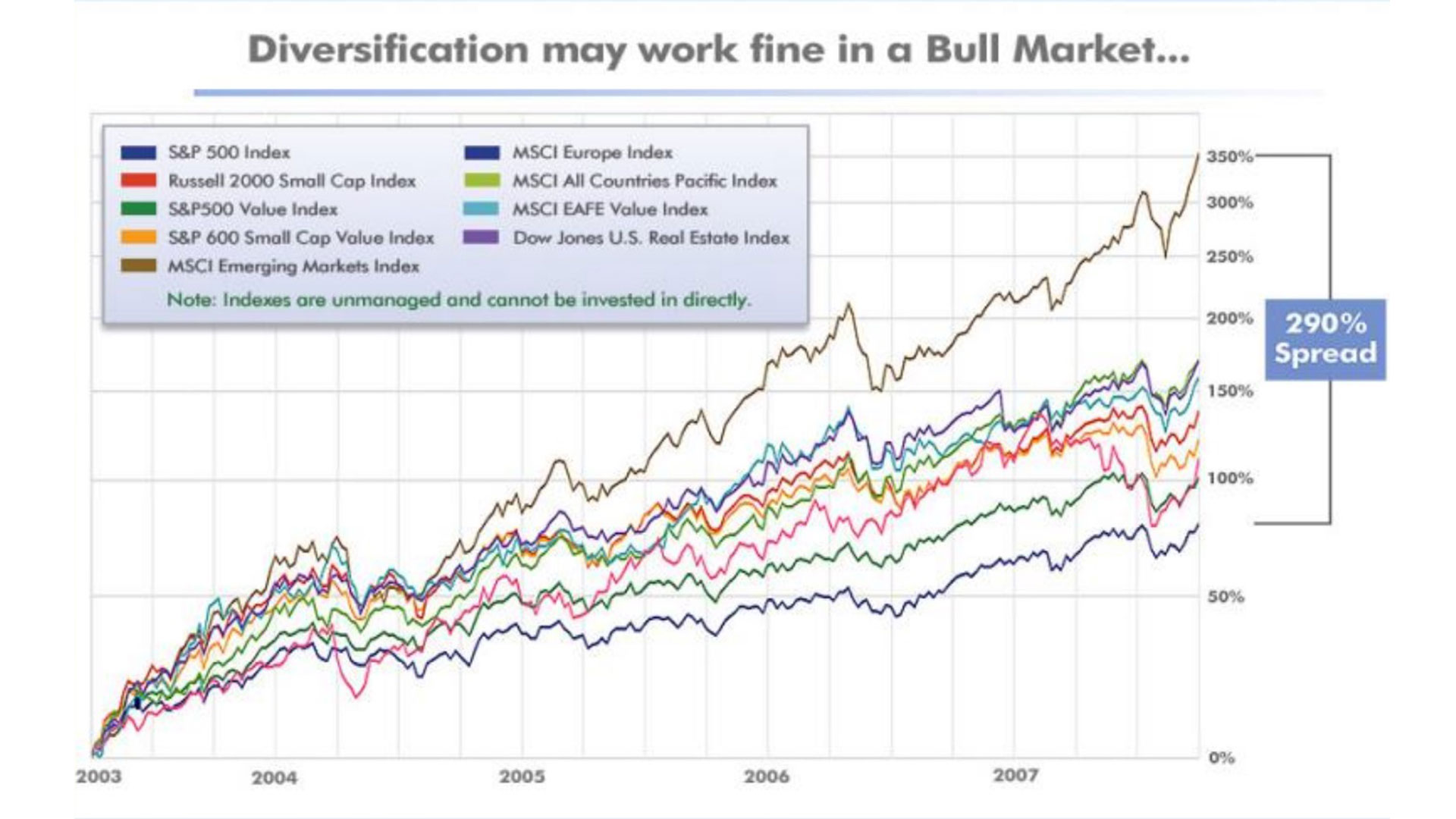

Diversification may work fine in a Bull Market…

As we mentioned above, one of the most widely followed theories is that diversification protects investors in declining markets. The idea is that different types of investments will march to the beat of different drummers, and so – theoretically – while some asset classes are going down, others might be going up.

This chart shows that diversification across nine non-fixed-income asset classes, works pretty well in a Bull Market, producing a very wide dispersion of returns – almost 300%, from top to bottom. Even though all these asset classes were generally up-trending, they definitely went up at different rates providing the desired ‘diversity’ in returns.

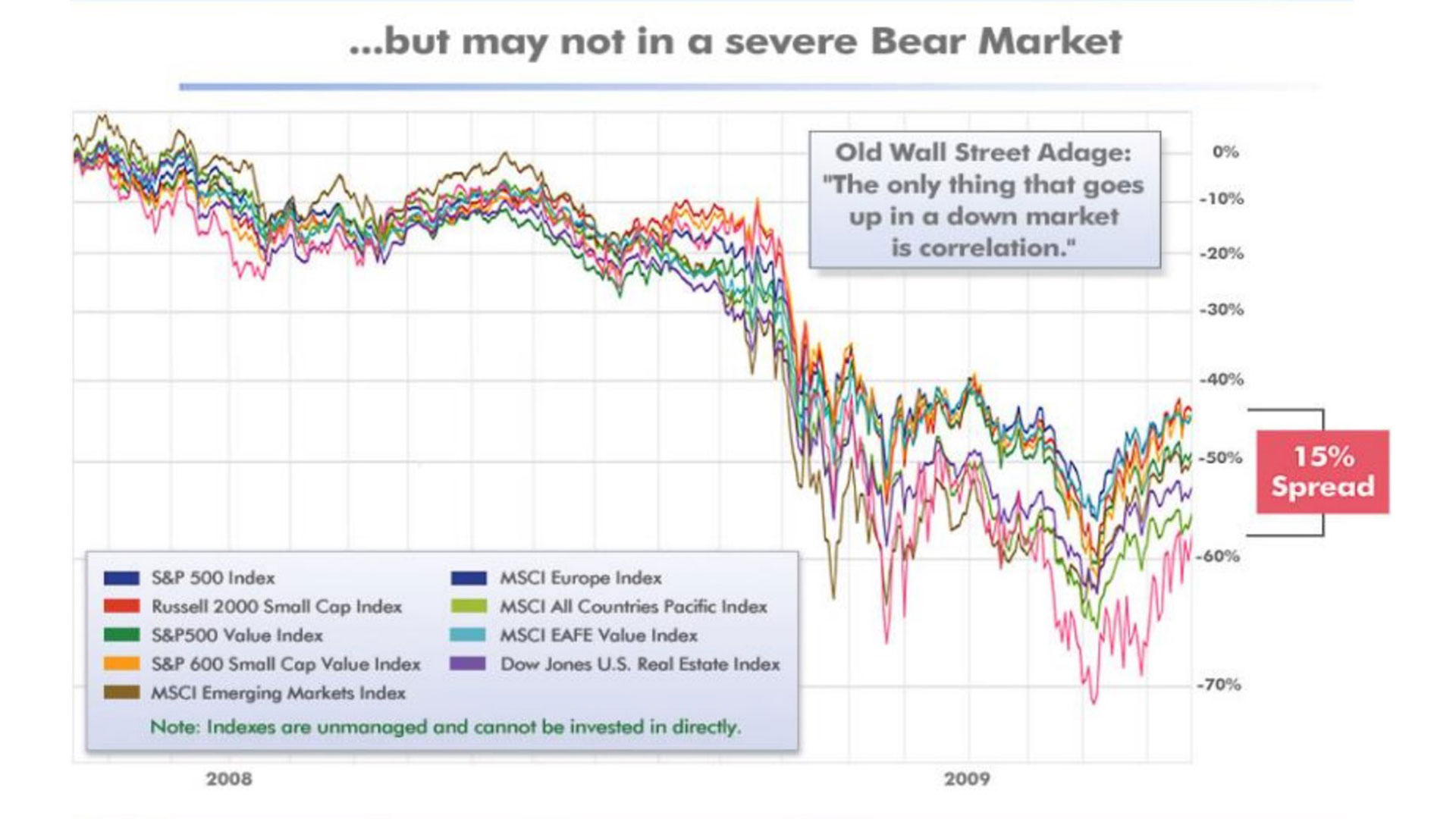

Most people have used some form of diversification to attempt to manage downside risk in their portfolio and the reality is, in most all bear market declines, Diversification alone did very little to help control loses in the average investment portfolio.

…but poorly during a severe Bear Market.

As you can see even though this diversified portfolio performed well and recovered in the period from spring of 2003 through the fall of 2007, in the Bear Market that followed from fall of 2007 to the spring of 2009 this diversified portfolio gave up all of the gains. And as you can see the dispersion of returns collapsed dramatically. The supposed benefits of diversification across these nine asset classes, just weren’t there: An almost 300% dispersion of returns during the Bull Market, shrank to a tiny 15% dispersion of returns during the Bear Market.

This collapse of dispersion means that the correlation of the returns among these asset classes skyrocketed! ‘Correlation’ is the tendency of one asset class to behave like another.

What risk controls does Harvest employ?

Diversification, then, has the obvious shortcoming in that it offers very little protection during a down market. The question is, what can we employ in your portfolio that adds extra layers of protection? There are three primary risk controls that we employ. Each serves a different purpose but all aim to limit your losses.

An important factor to remember is this: a portfolio which drops 10% must then grow quite a bit more than 10% just to recover the losses. This means that any dip/loss in your portfolio can hinder the overall efficiency of your investments. This is why Harvest has such a strong emphasis on downside risk controls. This is one of our keys to Harvesting Gains and Limiting Losses.

Three Primary

Risk Controls

Moving Averages

Harvest uses moving averages as a critical component for tracking the momentum of a fund or sector. This helps us stay in tune with whether a holding or prospective holding is trending in or out. By pitting two moving averages against each other (one faster and the other slower) you can gain insightful signals which inform buys and sells.

Trailing Stop Losses

Harvest uses trailing stop loses to help obtain ideal price points. This is especially critical in intraday traded models such as the Daily Harvest. A trailing stop lose is essentially a price cushion set by a trader when he intends on selling out of a fund. When a price begins dropping it uses up that cushion and triggers a trade. This is especially useful for navigating volatility.

Relative Strength Rankings

Harvest uses relative strength rankings to help determine the health of a set of funds or sectors. This works by comparing the strength of earnings of often a large sample of businesses and filtering out the weakest performers. This is especially helpful in our models that don’t use ETFs and instead use an array of individual stocks. In a race of 500 runners, we only want the fastest runners.