Start a rollover today.

Start an IRa and rollover your 401k balance into it

If you are interested in rolling over your retirement account into an IRA account with us, you can use this button to start that process. We’ve provided step by step instructions for how to complete this process.

1. Start an account with Harvest Investment Services.

To get started with your rollover, we first have to establish an account to put it in. We will start by getting you set up with Harvest’s client portal. If you already have an account login, you can skip this step and step 2 and go straight to your dashboard.

You can follow this get started button, which will start the process of setting up your Harvest Profile.

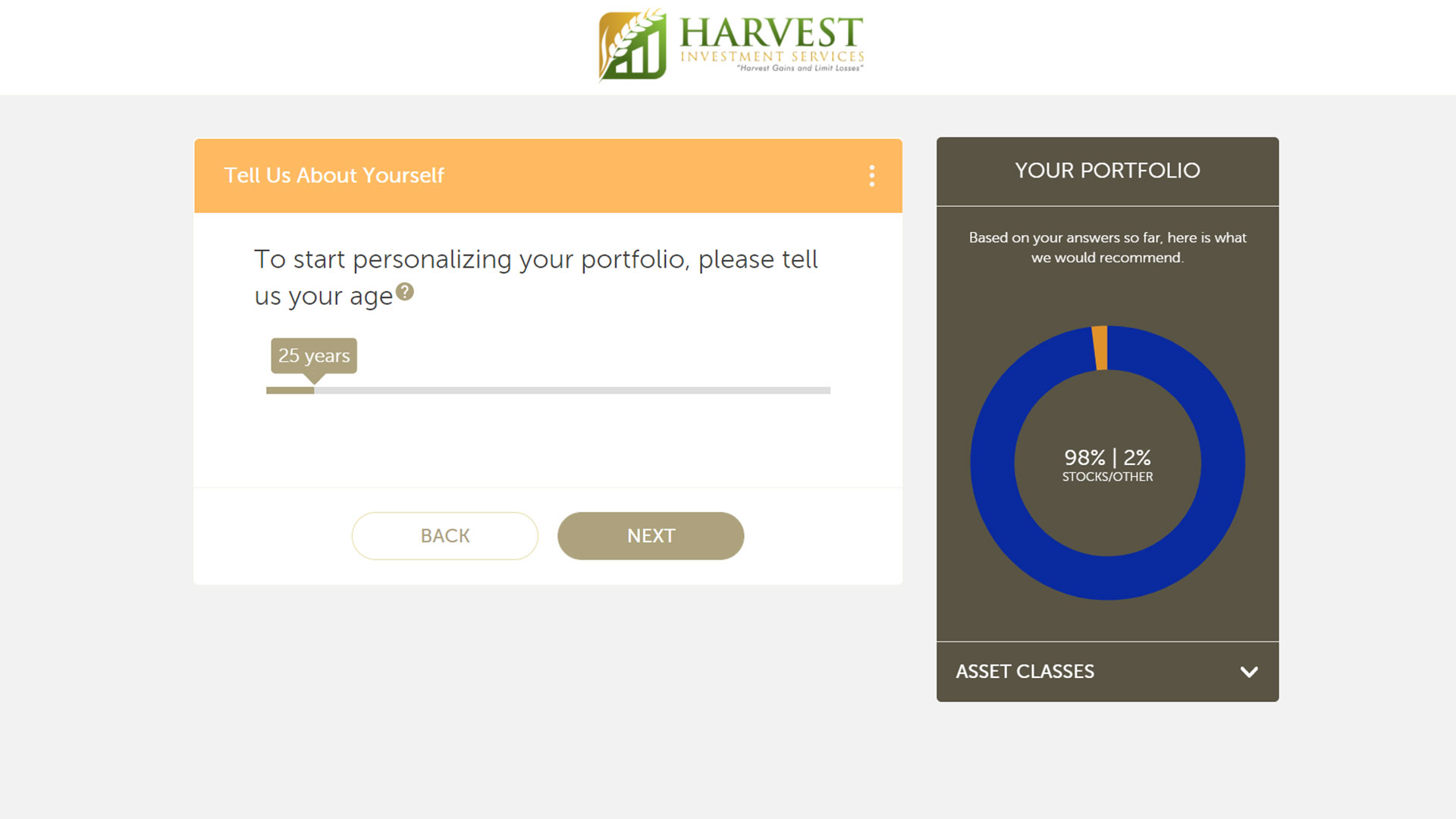

2. Fill out the short questionnaire.

Once you begin the process you will be lead through a short questionnaire. This, again, is to begin the process of setting up a new portfolio and profile account with Harvest. Here you will answer questions about your basic info, as well as risk tolerance and investment objectives questions.

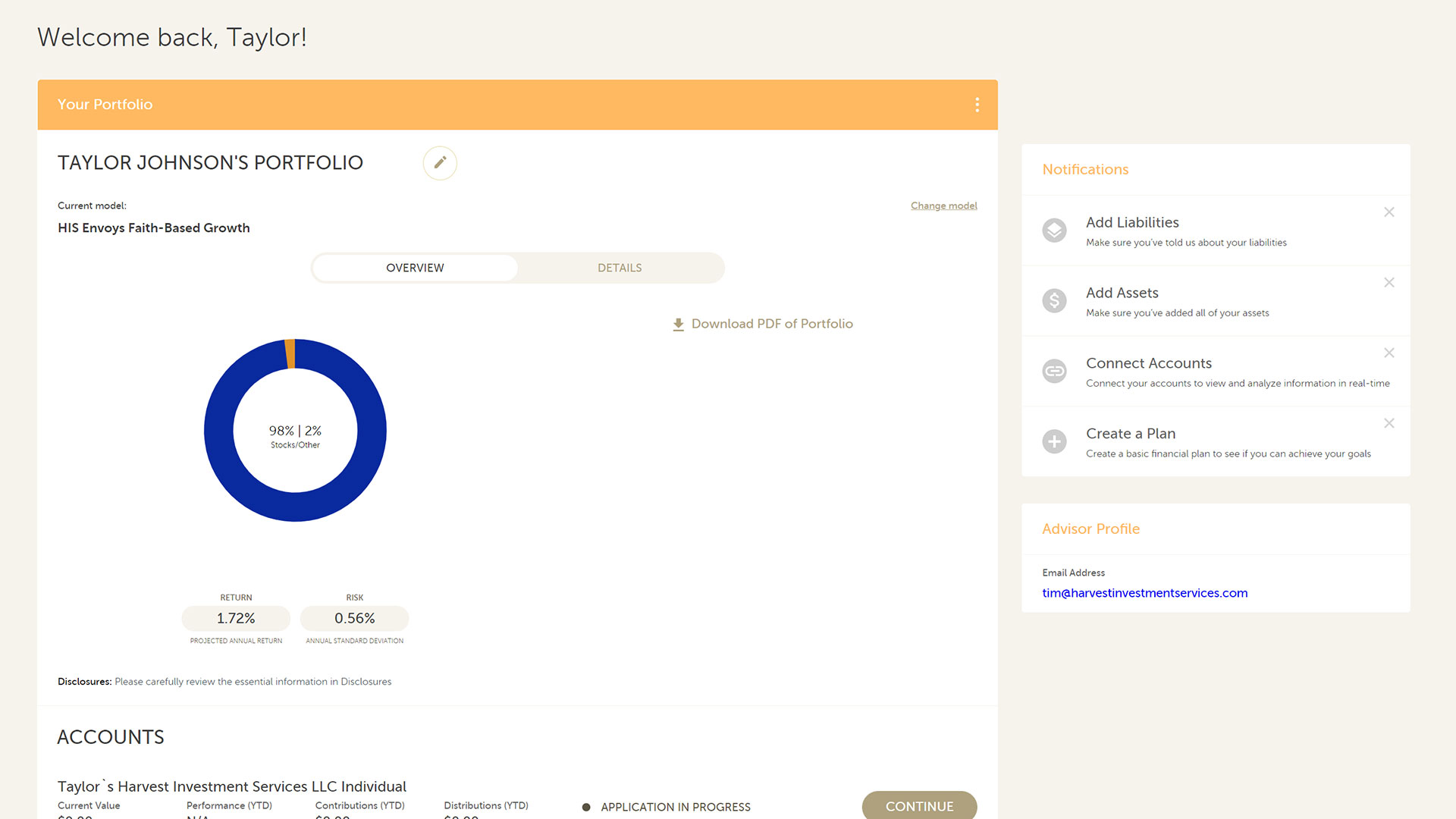

3. Once on your dashboard, click on “Open an Account.”

Once you complete the portfolio creation portion, you should be directed to a dashboard, similar to the screenshot. Here you can Manage your Harvest account, connect other accounts, assets you want to keep track of, as well as create a basic financial plan if you do not have one already.

To continue on our process, you will want to scroll down to the “Accounts” section and click on “Open an Account.”

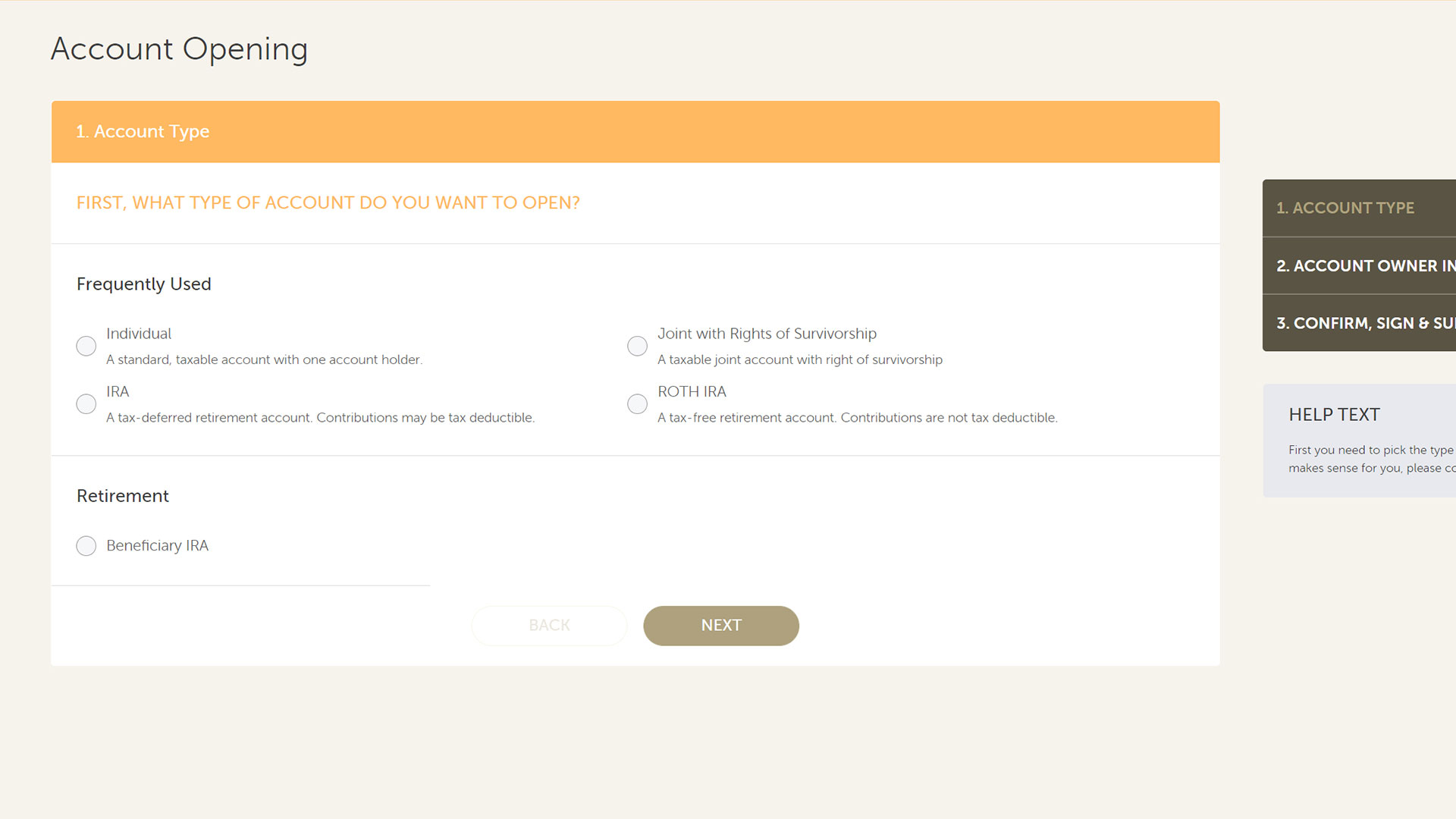

4. Select “Traditional IRA/Rollover IRA” for the account type.

Now that we’ve started the process of opening an account, we will want to select the correct account type. Assuming you are rolling over from a 401k to an IRA, you will want to click on IRA for the account type, which is a tax-deferred retirement account. Contributions may be tax deductible.

This will start the correct account application, which will provide you with a new IRA account.

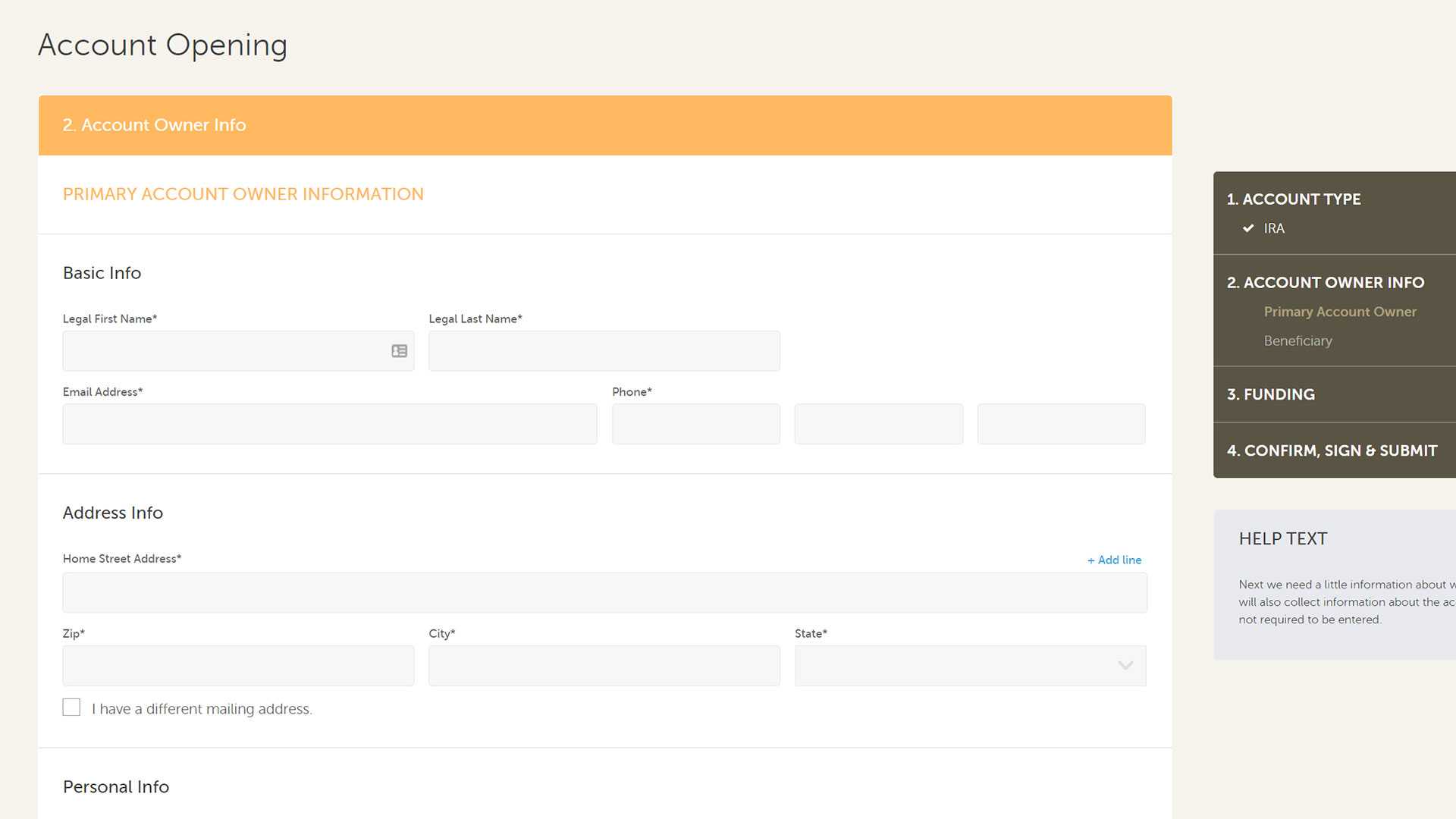

5. Go through the process and finish the listed steps.

You will need to go through the rest of this 4 step process. Here you will securely transmit the personal information we will need in order to establish your account. If you need to resume the process as a later date, you can always resume the application by logging back in to your account, scrolling to the “accounts” section, and clicking continue on the correct application.

6. Once completed, electronically sign your account application.

Finishing the information collection and funding portion will bring you to the last step in establishing your IRA, which is to provide your authorizing signature. You should be automatically directed to the DocuSign, which will instruct you on how and where to sign. If you are not redirected automatically to the signatures portion of the process, please refer to your email inbox, which should have a copy of the notification (or also check your spam folder).

With the signatures in place we can quickly establish your new IRA account and get it funded. With the account set up, we will be able to rollover your 401k into the new account. Please refer to the section below for the full instructions on how perform the rollover.

Rollover Instructions

Direct your rollover to TD Ameritrade. Have the check made payable to: TD Ameritrade Clearing, Inc. FBO “Your Full Name”. You can have them send the check directly to TD Ameritrade.

If the check is sent directly to you, you may send it to one of those addresses or please contact Luke Baumgarten:

630.613.9230 x 104 | luke@harvestinvestmentservices.com

Overnight:

7801 Mesquite Bend Drive

Ste. 112

Irving TX 75063-6043

Regular Mail:

P.O. Box 650567

Dallas TX 75265-0567